Whether there’s a fiscal year budget or a continuing resolution the government never stops spending. So contractors can never stop selling. It’s helpful to know the most promising hunting grounds, though. The Federal Drive with Tom Temin got some startling facts now from Deltek senior research manager Ashley Sanderson.

Interview transcript:

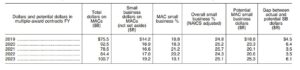

Tom Temin And in your most recent market surveys that you have published, one thing I noticed that you found in the category of opportunities in full and open competition, the unrestricted, if you will, is that spending is up sharply in 2023, the latest year we have the full spending for way up. But the number of contractors is going down, and that’s something I thought was only happening in the small business set aside area. Tell us more of what you found.

Ashley Sanderson Yeah, absolutely. So total contracts has definitely been trending up in the last several years. If we look back a couple of years, we see 662 billion in ’21, 707 billion in fiscal year 2022. And then as you said, 776 billion in fiscal year 2023. While that spending is increasing, we are seeing that the individual companies receiving the money keeps decreasing. We think the trend is driven primarily by category management policies within the federal space, which is leading agencies to either rely on existing governmentwide contracts for procuring goods and services, rather than issuing their own agency specific contracts, or they’re consolidating their existing contracts into one large opportunity. We saw that on some opportunities last year on the top jobs list, and we’re seeing it on this year’s list as well.

Tom Temin So in other words, as the government tries to streamline procurement and more people go to the task order model, as opposed to just open market for everything, it tends to compress the contractor base.

Ashley Sanderson Absolutely. So prime contractors are increasingly facing sort of that heightened competition, because there are fewer and fewer opportunities for them. One thing that we’ve heard that they’re using to combat this is obviously looking more into subcontracting, even if people are particularly prime contractors, just to get more business, take that onus off of them of being a prime. There’s even talk of people looking more into the commercial market or looking into the state and local contractor market as also to combat this.

Tom Temin And those in the information technology area always assume that’s the biggest category of spend, but that’s actually not the case, is it?

Ashley Sanderson True, not the case this year. It was an interesting change. I will pad that was saying and it is skewed a bit because it’s one particular opportunity that’s throwing us. But this year we saw that Health Services was actually the top area where we see the most money. That is due to a requirement the Community Care network, next generation that’s coming out of Veterans Affairs. That has been on the list actually for a few years now due to delays because it just sort of continues to balloon and grow. They modify services, they’re changing how they’re covering their different VA visit ins. And it’s ballooned now to $196 billion. So that’s the lion’s share of value in this list.

Tom Temin And that’s your largest unrestricted opportunity you see for the coming year.

Ashley Sanderson Yeah.

Tom Temin And then it drops to about a third that size for the number two. Tell us about two, three and four. What you see ahead is the big opportunities.

Ashley Sanderson So professional services falls into our next spot, which is also pushed into that area because of a huge opportunity that is new coming out of the Army, but demonstrates this consolidation. So the Army has a new requirement coming out called the Marketplace for Acquisition and Professional Services (MAPS). And MAPS recently came about. It is a combination of the Army’s giant RS3 vehicle that they had, as well as combining armies ITES-3S. So originally RS3 was to be re competed as a vehicle called ascend, ITES-3S was just going to move into ITES-4S and then they surprised us all and put them together. So now we have this giant behemoth C5ISR, IT services requirement that’s coming out. So that has also pushed professional services into that second rate slot, because it’s over $50 Billion.

Tom Temin Sure. And the Army is also a big user of some of the government wide GWACS that are out there also, besides its own vehicles.

Ashley Sanderson Exactly.

Tom Temin So where does IT come in here?

Ashley Sanderson We finally see IT there in that third slot for the leading and spending. But I will say that IT leads in the amount of opportunities that we see on that list. The front end of the heavier loaded list.

Tom Temin We’re speaking with Ashley Sanderson. She’s senior research manager at Deltek. And there’s a couple of things people have been waiting for. There’s another SEWP coming. Alliant three out of GSA, these have been delayed. These take a long time these things. I think SEWP is a little bit more regular in its issuance than Allient has been. What’s going on? GWAC wise?

Ashley Sanderson GWACS, so that’s talking about our fiscal year 2024 status update. So SEWP has moved in to the post RFP area. Alliance moves into post RFP. But we do have a new Ascend coming out of GSA, which is going to be their large cloud GWACS that’s coming out hopefully in fiscal year 2025. It’s also a very, very new kind of just being formed. But we’re estimating that it’s going to come out in fiscal year 2025.

Tom Temin Right, if it’s not protested to death.

Ashley Sanderson Right.

Tom Temin And in the professional services area, which is, I guess, the bigger part of, services out way in terms of dollars products nowadays, I think is pretty much established. The bulk of spending or almost all the spending is follow ons. Tell us more what you found there.

Ashley Sanderson Yeah, absolutely. Well overall, the list we see is primarily follow ons, but professional services is all follow on requirements. Again, I think it’s due to just overall what we’re seeing in the government with less and less competition. They are consolidating these requirements like not to fall back with my example of MAPS, where you have a professional services just kind of being combined and combined, and there’s no room for new stuff, even though what you may be even listed as new like MAPS, it still is technically a follow on if you really want to get technical about it.

Tom Temin Right. So your best advice for contractors then is to do a really good job when you get a contract, and try to get the follow on.

Ashley Sanderson Absolutely. That’s your way in whatever way in you can go teaming, subbing, just getting into these contracts, because these new opportunities without anyone that’s previously provided services are really becoming a thing of the past.

Tom Temin And it’s really important to get on the right GWACS too.

Ashley Sanderson Yes. Yes, absolutely.

Tom Temin Because they have long lives, and they also have follow ons.

Ashley Sanderson They do. And they do have very long lives, we think.

Tom Temin Sure. And just briefly, how do you go about getting this information? What does Deltek have? There’s a lot of databases out there.

Ashley Sanderson A lot of databases. So to give you a background, Deltek has been doing these reports for 20 years now to look at bellwether opportunities, what we’re looking at for future forecasting, as well as looking back at all of our past database that we have of all the previous awards, all the contract spends. All of these, there’s four reports this year. There’s the top 20 unrestricted that we’re discussing. There also is a top ten small business, a top ten professional services, and a top ten AEC or architecture engineering and construction report. These 50 opportunities are drawn from the Deltek IQ solution business development tool that we have, and then it gets vetted by Deltek’s team of analysts. All of the opportunities have a solicitation date for fiscal year 2025. And these are selected based on total expected contract value or the anticipated ceiling value. Each of the report also contains details of contract spending trends within the market, a recap of fiscal year 2024 and then obviously the outlook for 2025.

Tom Temin And for those that haven’t been through multiple election cycles. And we are in really an interesting one right now, just days to go. What should people take away from the phenomena of the election and of the continuing resolution, I guess, is the other irregularity?

Ashley Sanderson Sure. We’ve been operating in a continuing resolution environment for a long time now, and elections do cause people to wonder, what does this mean for contracts? Are we going to see increased cancellations? What could happen? And looking back over the years at the data, there is just no proof that elections cause cancellations, and really that concern your resolutions do either you don’t see an increase in cancellations. What I can say is you do see more delays. CRs do cause delays and election cycles just based on you have a changing of the guard. Things are different. You’re going to see delays, but it doesn’t mean that you will see cancellations. So just prepare for a slower process this year perhaps.

The post Where federal contract spending is headed in 2025 first appeared on Federal News Network.